Minimum Hourly Wages in Michigan

As of January 1, 2026, workers in Michigan are entitled to the highest between:

- $13.73 per hour (Michigan Minimum Wage);

- $18.15 per hour or more, if you work at an “H-2A Job” (please visit H-2A Jobs for more information); or

- The wage rate in your contract, your employer promised you, or established through your working arrangement.

Piece Rates

A piece rate is a rate where wages are calculated by what you produce, such as paid per box, pound, or acre completed. The minimum hourly wage is required, even if your employer pays you “piece rate”.

Your employer must:

- Pay a high enough “piece rate” wage that you make at least the minimum hourly rate or

- Supplement your “piece rate” so you make at least the minimum hourly wage.

For example, an individual who works 40 hours and picks 180 cartons of blueberries in a pay period with the promise of a piece rate of $2.00 per pound must receive the larger minimum wage rate of $499.20 (40 hours x $12.48/hour) or, if they are working at an "H-2A” Job, $726 (40 hours x $18.15/hour). Workers are entitled to the highest rate, and in this example, the hourly rate is higher than the piece rate of $360 (180 pounds x $2.00 per pound).

In this same example, if the worker were to produce 300 (300 x $2) cartons of blueberries, within the same 40 working hours, the worker is entitled to the higher rate of $600 for the week.

Overtime Pay

Generally, agricultural work is not eligible for overtime pay. However, if non-agricultural work is performed in a workweek in which a farmworker performed more than 40 hours of work, than that workweek may be eligible for overtime pay.

Examples of non-agricultural work, that farmworkers may be asked to do, include, but not limited to:

- Cleaning the housing units of other workers;

- Primarily cooking for other workers;

- Processing, packaging, and/or transporting a different farms produce;

- Construction or repairment of machinery, fences, etc.;

- Driving workers to non-ag locations (i.e. laundromats, stores, banks, etc.).

Overtime pay is calculated at a rate equal to time and one-half (1.5x) of the regular rate of pay for hours worked over 40 in a workweek. If the regular rate is $12.48, then the overtime pay rate is equal to $12.48 plus $12.48 divided by 2, which equals $18.72. Therefore, if a worker is eligible for overtime pay, works 45 hours, and is normally paid $12.48 per hour; they would be owed at least $592.80 in wages:

40 hours of work at their regular rate of $12.48/hour: 40 x $12.48 = $499.20

plus + 5 hours at the overtime rate of $18.72/hour: 5 x $18.72 = $93.60

Equals = $592.80

H-2A Jobs That May be Entitled to Higher Wage Rates

Generally, H-2A jobs must be paid a minimum hourly rate of at least $18.15 in 2025. However, workers who perform the following duties may be entitled to a higher hourly wage rate for all hours worked in a week:

- Fence Erectors - $20.70 per hour

- Erect and repair fences and fence gates, using hand and power tools

- Light Truck Drivers - $21.50 per hour

- Drive a light vehicle, such as a truck or van to pick up merchandise or packages from a distribution center and deliver. May load and unload vehicle

- Construction Laborers - $23.93 per hour

- Perform tasks involving physical labor at construction sites.

- Farm Equipment Mechanics - $24.04 per hour

- Diagnose, adjust, repair, or overhaul farm machinery and vehicles, such as tractors, harvesters, dairy equipment, and irrigation systems

In addition, you may be owed overtime pay for any workweek in which you performed any of the above duties and you worked more than 40 hours.

If you have an H-2A visa and your job is solely to perform the duties above, your employment may be misclassified as an agricultural job, and you may be entitled to a higher wage rate. Please visit H-2A Jobs for more information on your rights working under an H-2A Contract.

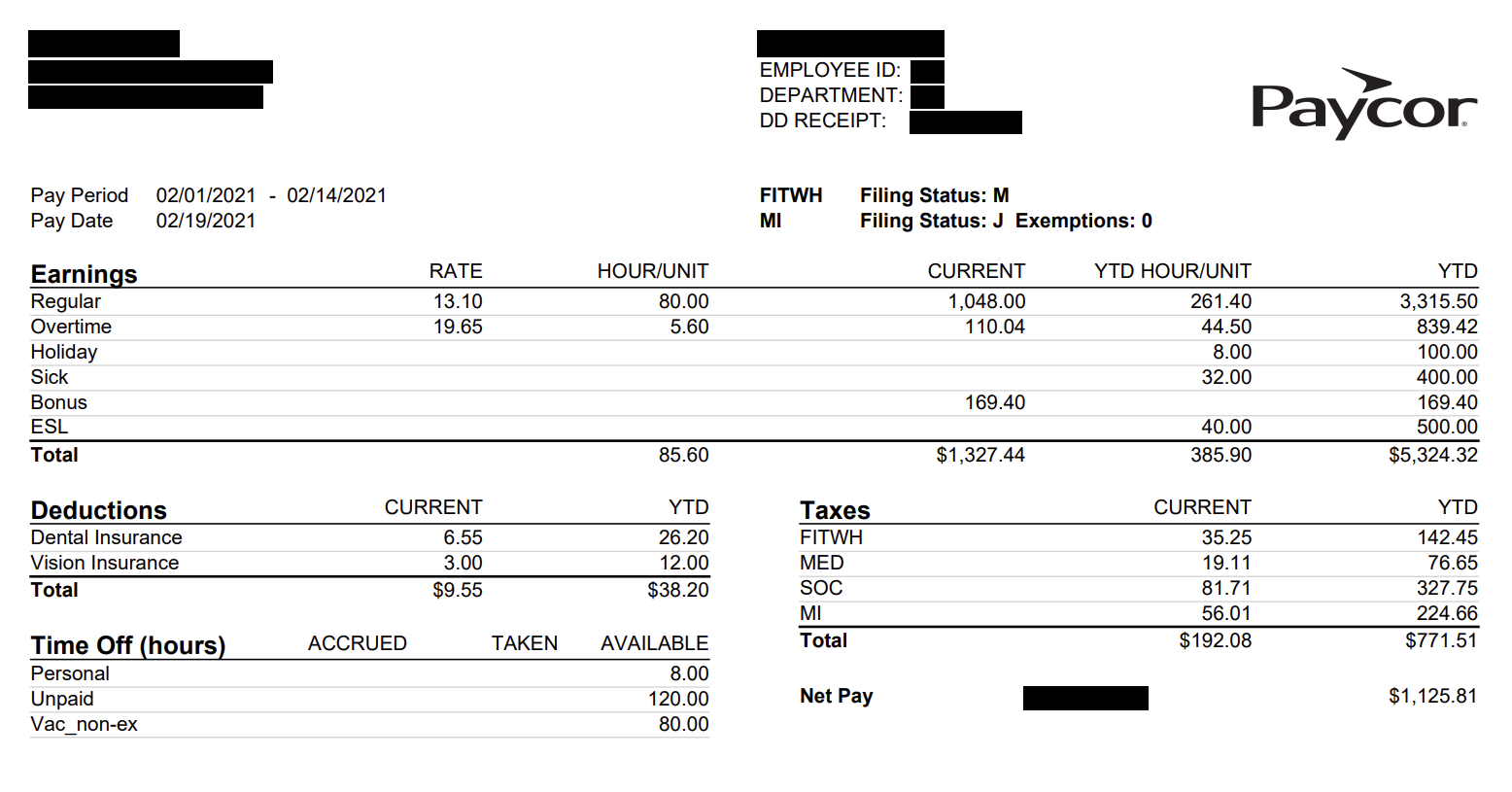

Wage Records and Paystubs

Employers must keep a separate record, wage statement, or paystub for each worker, even for children, and provide each worker a copy of their individual work record each pay period. A paystub, also known as a paycheck or wage statement, summarizes an employee's hours worked, earnings, deductions, and taxes in a pay period. Some pay periods vary, where workers are generally provided with paystubs on a weekly or biweekly basis. Paystubs or wage statements must include the number of hours you work during a pay period and the amount you earn based on your hourly wage. If your employer pays you a piece rate, they also must include the number of pieces you picked during the pay period and your piece rate.

You should write down your hours, even if your employer pays you a piece rate! Every day, write the time you began working, the time you quit working, and any lunch and break times. Also, record your “pieces” worked that day. If there is ever a dispute about your wages, having your own accurate record can help you collect your pay.

Use your records to calculate your hourly wages and piece-rate wages to determine which is higher. Your “gross pay” (total pay before deductions) must equal the LARGER of the amounts. If your employer does not pay you any part of your wages, they may owe you money for damages in addition to your wages.

Your employer must pay each worker with a separate paycheck, separate from spouses/partners, children, and other relatives

Example of a Paystub

Pay Period - The dates that are covered by the paystub.

Pay Date - This date is when your employer should have paid you.

Earnings - A summary of your work and pay in a pay period

Regular - Hours worked in a pay period.

Overtime - Generally, workers who work over 40 working hours within a 7-day period are entitled to overtime. Agricultural workers, though, are exempt from earning overtime pay. However, workers who perform non-agricultural work, which may include those working in food processing/packaging facilities, may be eligible for overtime. Overtime pay applies to any hours worked above 40 hours within a work week and is equal to 1.5 times the regular hourly rate.

Rate - The salary you should be making per hour or by piece rate. A common example of piece rate is for a worker to be paid a certain amount per basket, or box of produce harvested.

Hour/Unit - Total hours worked or a total amount of pieces completed in a pay period

Deductions - Though not common, if approved in writing by a worker, deductions can be taken out of one's check.

Time off - Some workers will have time off accrued in their checks. This time shows you the total balance of your time off, such as unpaid or paid time off, or vacation time.

Employee - Your name should appear here

Pay - Total pay before taxes

Taxes - All workers in the U.S. have to pay federal and state taxes. This section shows you how much is taken out of your check. Reminder: H-2A workers are exempt from paying Medicare and Social Security taxes.

Net Pay - The amount of money you will take home after taxes and other deductions

Summary - A total summary of your pay.

Total Pay - Total wages earned before taxes and deductions.

Current - Total amount paid in the current paycheck, broken down by types of earnings. Here, Regular, Overtime, and Bonus earnings are listed.

Year to Date (YTD) Hourly/Unit - Total hours/units worked/produced during the year.

Year to Date (YTD) - Total wages earned before taxes and deductions in a year. This number will continue to increase as you continue your employment.

Workers should be paid in a timely manner:

- If you are a hand harvester, you must be paid at least once a week within two days after the end of the workweek, unless you agree in writing to a different payday. If your employer fires you or you are laid off, they must pay you within one day. If you quit your job, your boss must pay you within three days.

- If you are not a hand harvester (i.e. dairy, poultry, or swine worker), and you are fired, laid off, or quit, your employer must pay you on your regularly scheduled payday after the end of your employment.

Deductions

Your boss must deduct taxes from your pay unless you are working on an H-2A visa. Your boss cannot take any other money out of your pay (for housing, utilities, loans, etc.) unless you agree in writing.

- Though not limited to the following, some common deductions (whether lawful or not), can include costs for personal protective equipment (PPE), tools used for your job, rent and/or utility charges, loan payments (such as recruitment fees), employer-provided meals, and transportation to your workplace, home, stores, laundromats or other locations.

Workers with questions about their wages, deductions, or other wage-related issues can request a free, confidential consultation.